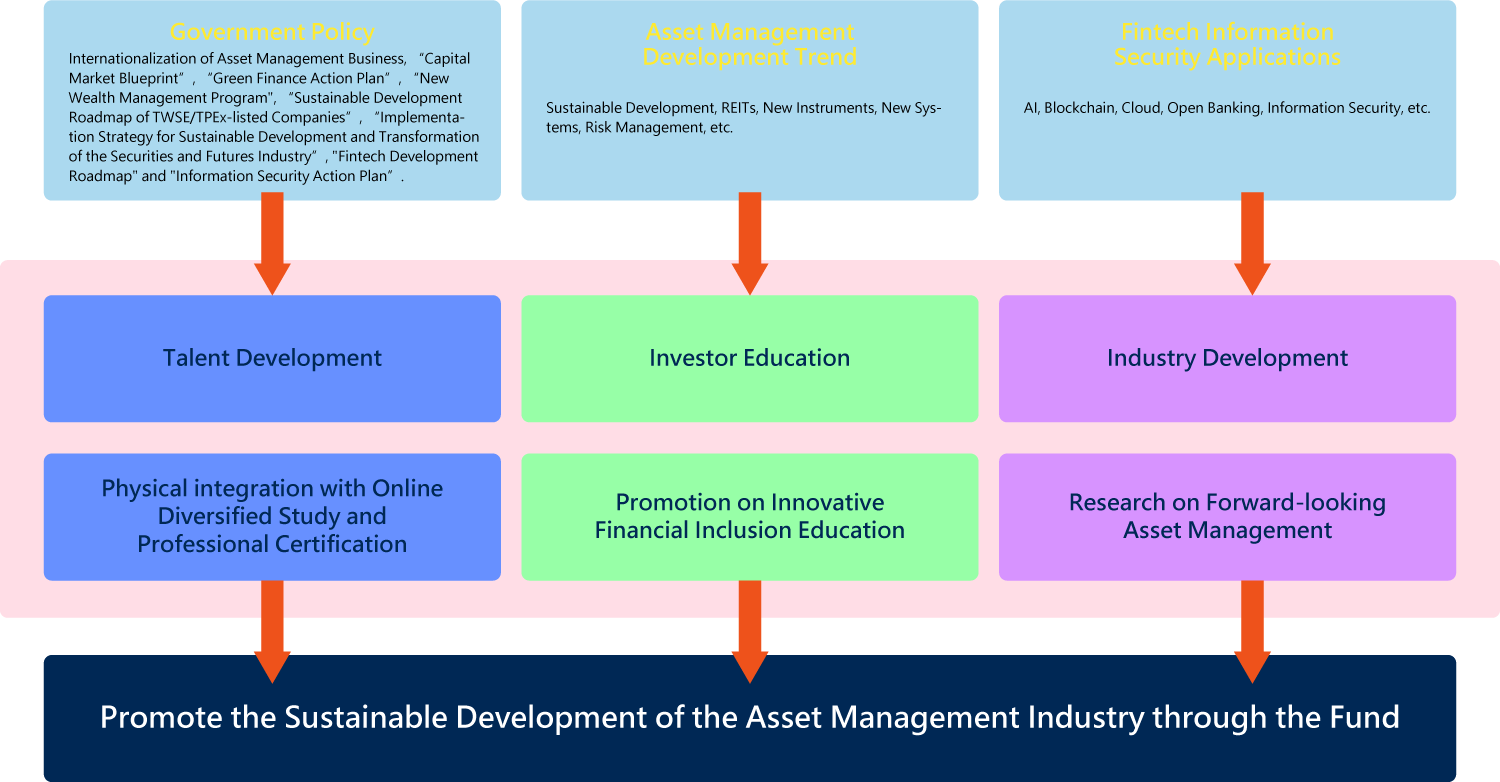

ORIGIN AND OPERATION OF THE FUND

BRIEF DESCRIPTION ON THE IMPLEMENTATION ACHIEVEMENTS OF THE THREE MAJOR ASPECTS REGARDING TALENT DEVELOPMENT, INVESTOR EDUCATION AND INDUSTRY DEVELOPMENT

1.Talent Development

(1)Senior managers (supervisors) (a total of 3 events with 100 participants): Expanding the international vision of senior managers, inspiring forward-looking mindset through domestic seminars and overseas field studies

The "Advanced Overseas Study Program" was organized to conduct visits advanced countries overseas to study asset management. In response to the COVID-19 pandemic, the "Study Camps for the Senior Executives of Asset Management" was held in Taiwan to enable senior executives of asset management to keep abreast with the global trends, take advantage of forward-looking development in global asset management, sustainable development, fintech, retirement systems and other development trends, so as to promote innovative business development in line with international developments.

Description of the implementation achievements of each activity, please visit the section of the implementation achievements of senior managers of the talent development page.

(2)Mid-level executives/senior practitioners (a total of 74 events with 5,295 participants): Strengthening the professional skills of the mid-level executives and senior practitioners across disciplines, and refining asset management and fintech expertise

In line with the development trends of domestic and international asset management, practical courses such as "Asset Management ALPHA+ Training Program", "Global Asset Management Workshop", "Private Equity Funds", and "Green and Sustainable Financial Talent" were organized to introduce international resources as well as help participants learn about advanced application technologies and driving new business development. Seminars on asset management practices such as "New Southbound Asset Management", "National Infrastructure Opportunities and Challenges", "REITs Opportunities and Challenges", "ESG Investment and Risk Management", "Financial Knowledge on Asset Management and Legal Compliance Series", and "Forward-looking Series on Asset Management" were organized to discuss business opportunities arising from international development and practical issues, integrate the current situation, legal system and future development trends of domestic and overseas industries, and inspire new mindset on business strategy development. Seminars on fintech asset management practices such as "AI Asset Management Practices", "Blockchain Asset Management Practices" and "International Fintech Asset Management Development Practices" were organized to guide significant advances in innovative technologies and trigger new developments in innovative services.

Description of the implementation achievements of each activity, please visit the section of the implementation achievements of mid-level executives/senior practitioners of the talent development page.

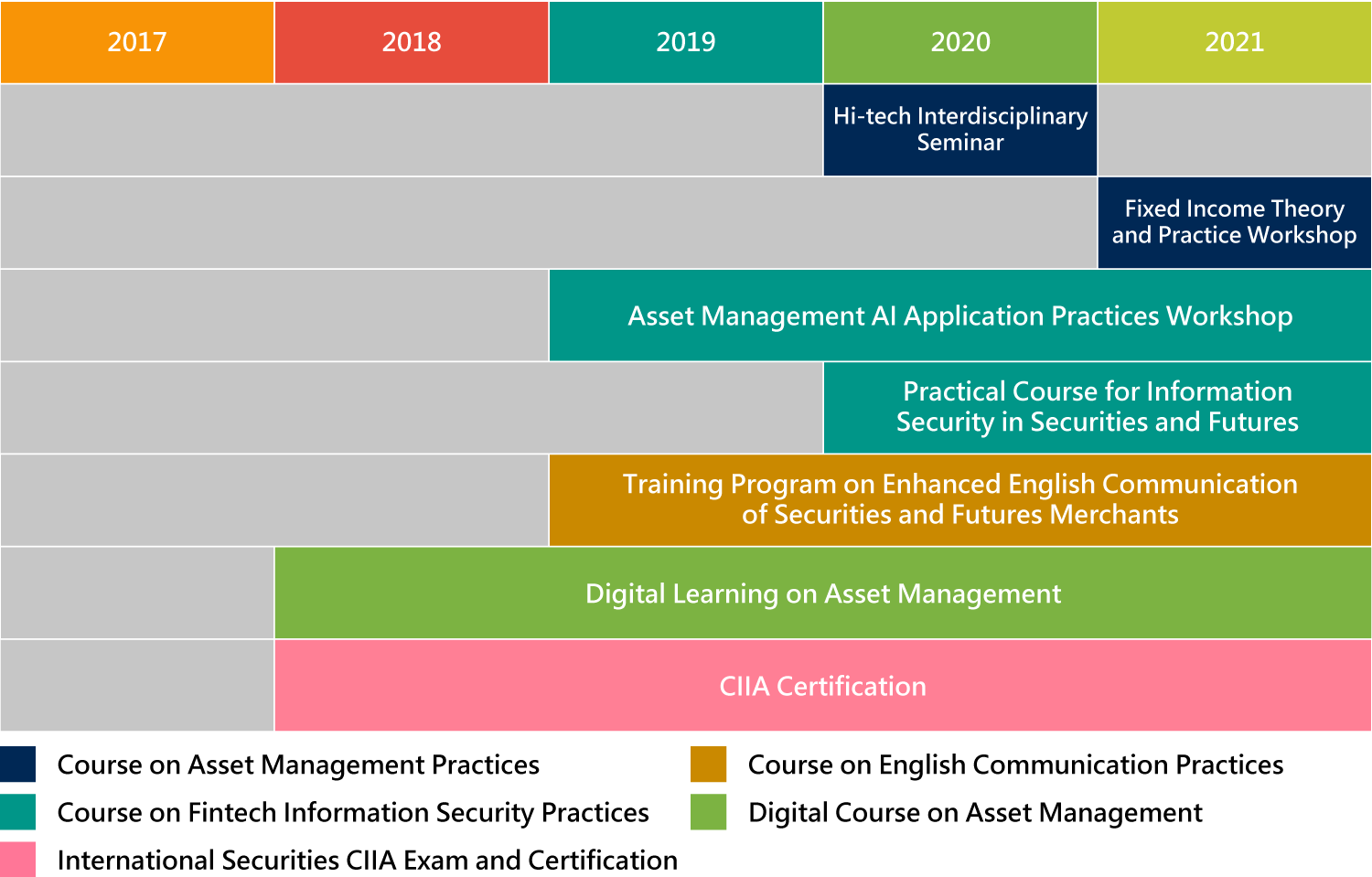

(3)General practitioners (a total of 125 events with 10,719 participants): Deepening expertise in asset management practices and analyses, fintech applications and English communication, thereby facilitating business integration with the international community

The "High-tech Interdisciplinary Industry Practice" and "Fixed Income Theory and Practice" were organized to enhance the innovative development of core professions such as forward-looking industries and fixed income instruments, and to promote the further upgrading of asset management business development. To strengthen fintech applications and information security governance, the "Asset Management AI Application Practice" and "Practical Course for Information Security in Securities and Futures" were organized to implement the construction of AI application infrastructure and information security system. Moreover, to improve the English proficiency of practitioners at financial institutions, the "Training Program on Enhanced English Communication for Securities and Futures Merchants" was organized to enhance the international competitiveness of the financial services industry. The "Digital Course on Asset Management" framework was created to develop digital courses on front, middle and back office practices was organized to enhance the learning efficiency and professional knowledge in a gradual manner. In order to encourage the improvements in professional capabilities to obtain international certificates, the "CIIA Foundation Exam and Use of Chinese" was organized to enhance the capabilities of Taiwan’s asset management talent.

Description of the implementation achievements of each activity, please visit the section of the implementation achievements of general practitioners of the talent development page.

(4)Others targets (juridical and prosecutor investigators) (a total of 8 events with 381 participants): Strengthening asset management profession of the court and prosecutor investigators to achieve sound development of the financial market

In order to enhance the expertise of the courts and prosecutor investigators in asset management and handling unlawful cases, the course on "Understanding Asset Management Market Practices" was organized to achieve the purposes of detecting unlawful activities, protecting the rights and interests of investors, and promoting the sound development of the market.

Description of the implementation achievements of each activity, please visit the section of the implementation achievements of other targets (juridical and prosecutor investigators) of the talent development page.

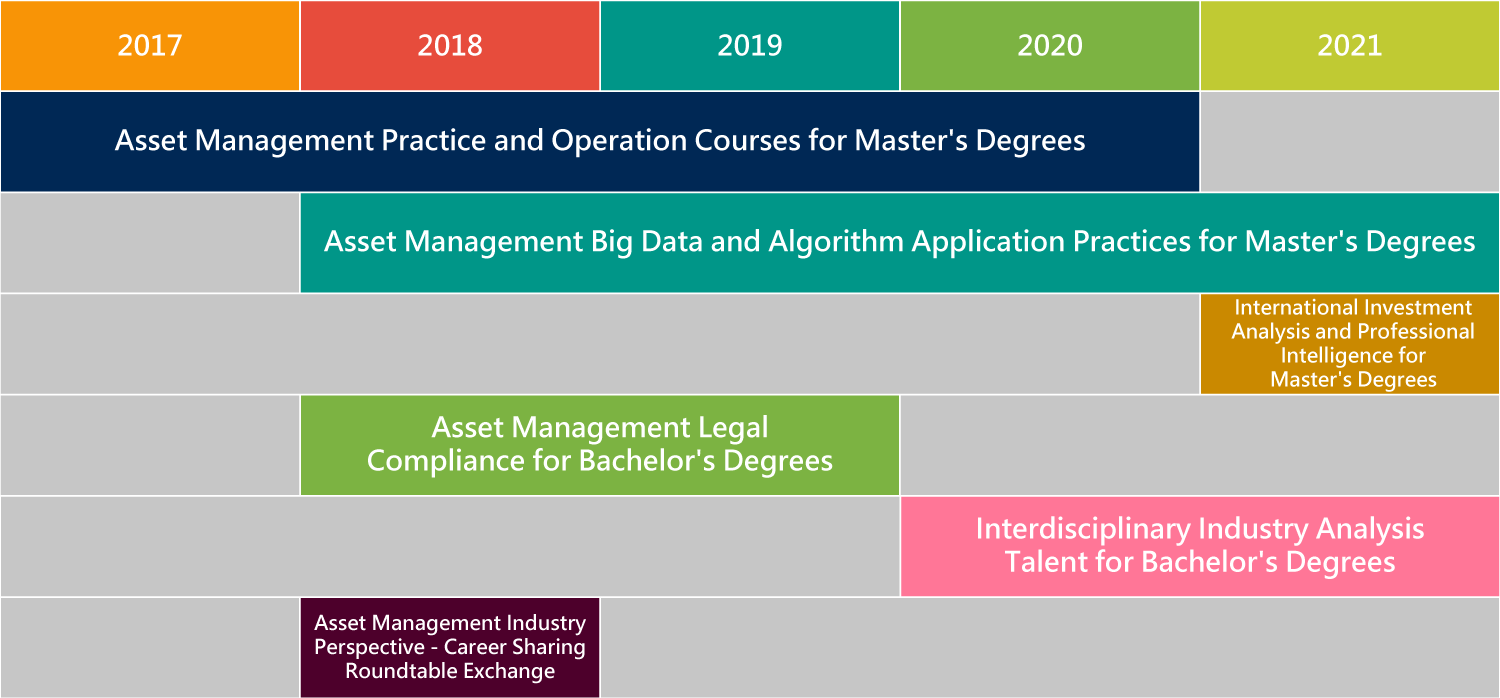

(5)Campus reserve talent (a total of 17 events with 884 participants): Nurturing diverse professionals on campus, building a talent database as well as internship and employment matching platform to provide industry-ready talent

Asset management has become increasingly mainstream throughout the finance industry. In order to cultivate interdisciplinary professionals and meet the needs of the financial industry, 5 practical credit programs, including "Asset Management Practice and Operation (Master's Degree)", "Big Data and Algorithm Application (Master's Degree)", "International Investment Analysis and Professional Intelligence (Master's Degree)", "Legal Compliance (Bachelor's Degree)", and "Interdisciplinary Industry Analysis Talent (Bachelor's Degree)", as well as the activity on "Career Sharing Roundtable Exchange" were organized. The courses are highly practical and in-depth, and integrate scenario simulations, career path sharing, and industry internships to enhance the practical experience of the students. After the training, students are added to the talent database for the industry.

Description of the implementation achievements of each activity, please visit the section of the implementation achievements of campus reserve talent of the talent development page.

2.Investor Education

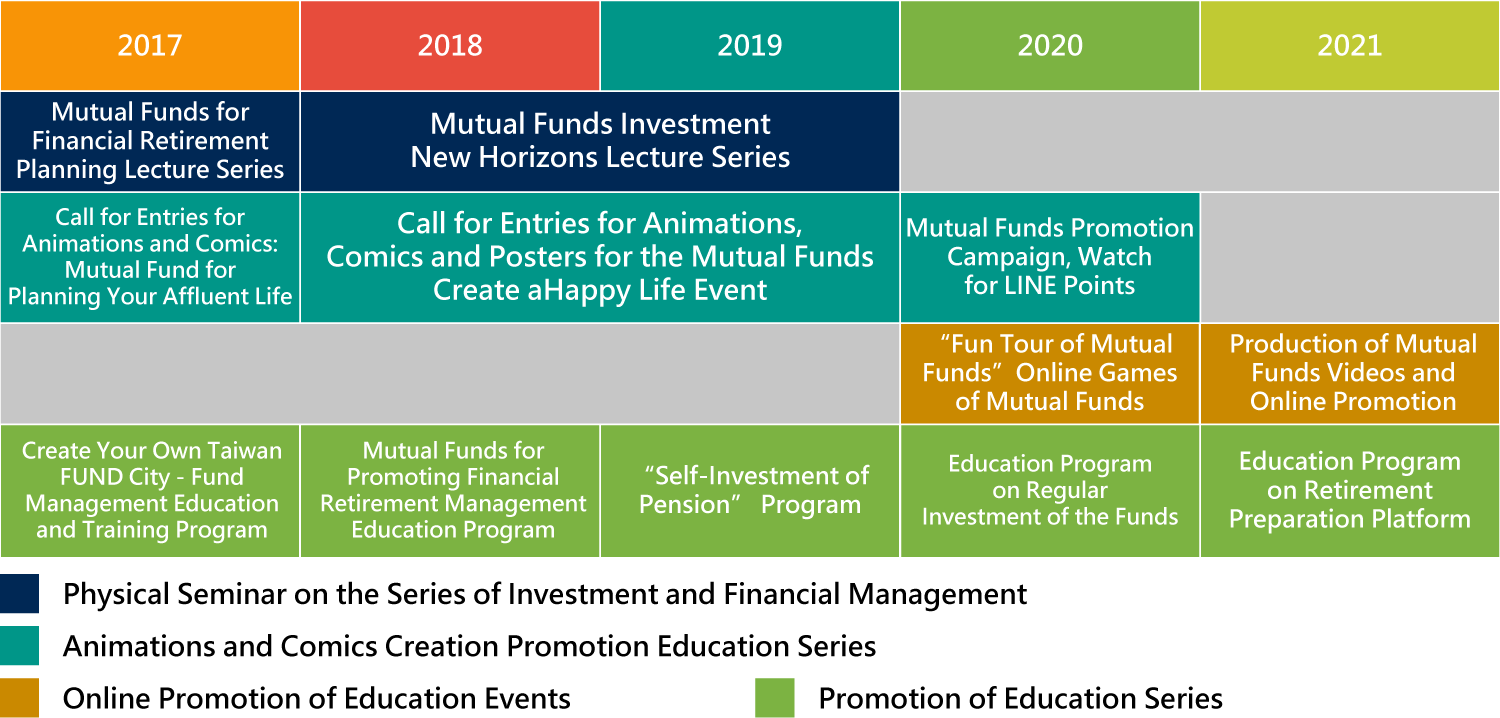

(1)General public (a total of 195 in-person and online events with over 50 million participants): Expanding the concepts of investment management, risk management and investment rights protection to enhance the benefits of financial inclusion, leveraging asset management to stabilize wealth growth, planning early for retirement, and achieving the goal of a happy life

The "Mutual Funds for Financial Retirement Planning Lecture Series" was organized to help the public understand the overall structure of wealth management after retirement as well as the concept of investment risk. With "Create a Happy Life with Mutual Funds" as the main theme, the "Animations, Comics and Posters Creativity Contest" and the "Mutual Funds Promotion Campaign, Watch for LINE Points" was organized to present outstanding works in a fun way. Furthermore, social apps were leveraged to extensively promote the characteristics of mutual funds, retirement preparation, and relevant financial management concepts. The "Online Games of Mutual Funds" and the "Online Promotion of Mutual Funds Video" were organized to promote the above concepts in an interactive manner through the Internet's ability to quickly and extensively share information Education and promotion programs, including the "Periodic Investment in Funds" and "Retirement Preparation Platform", were organized to promote the concepts of early financial management and retirement preparation, thereby helping members of the public achieve the goal of a happy retirement life.

Description of the implementation achievements of each activity, please visit the section of the implementation achievements of the general public of the investor education page.

(2)Junior high and elementary school students (a total of 5 events with 279 participants): Promoting parent-child learning to establish the goal of financial management in the family so as to enhance every family's financial knowledge

The "Financial Literacy Summer Camp for Families" was organized to bring financial knowledge to parents and children, and to allow them to learn about investment and financial management issues through field trips together, thus helping them develop their understanding of financial management concepts.

Description of the implementation achievements of each activity, please visit the section of the implementation achievements of the junior high and elementary school students of the investor education page.

3.Industry Development

Industry development (a total of 45 dynamic projects and 18 research projects): Understanding the trends of the international securities and futures market and studying the key issues of industry development to stimulate innovative development

In order to have a better understanding of the trends of international securities and futures market system and business development, the "International Securities and Futures Market Dynamics" has been regularly collected, compiled, and released to help companies expand their businesses with foresight. In response to the development trends of the international asset management market, research on key industry development issues such as "Asset Management Market System", "Fintech", "New Asset Management Instruments", and "International Competitiveness of Asset Management" have been conducted, to make specific recommendations for the reference of the competent authorities and help companies build connections with the international market.

Description of the implementation achievements of each activity, please visit the section of implementation achievements of the research on international securities and futures market dynamics and asset management development of the industry development page.

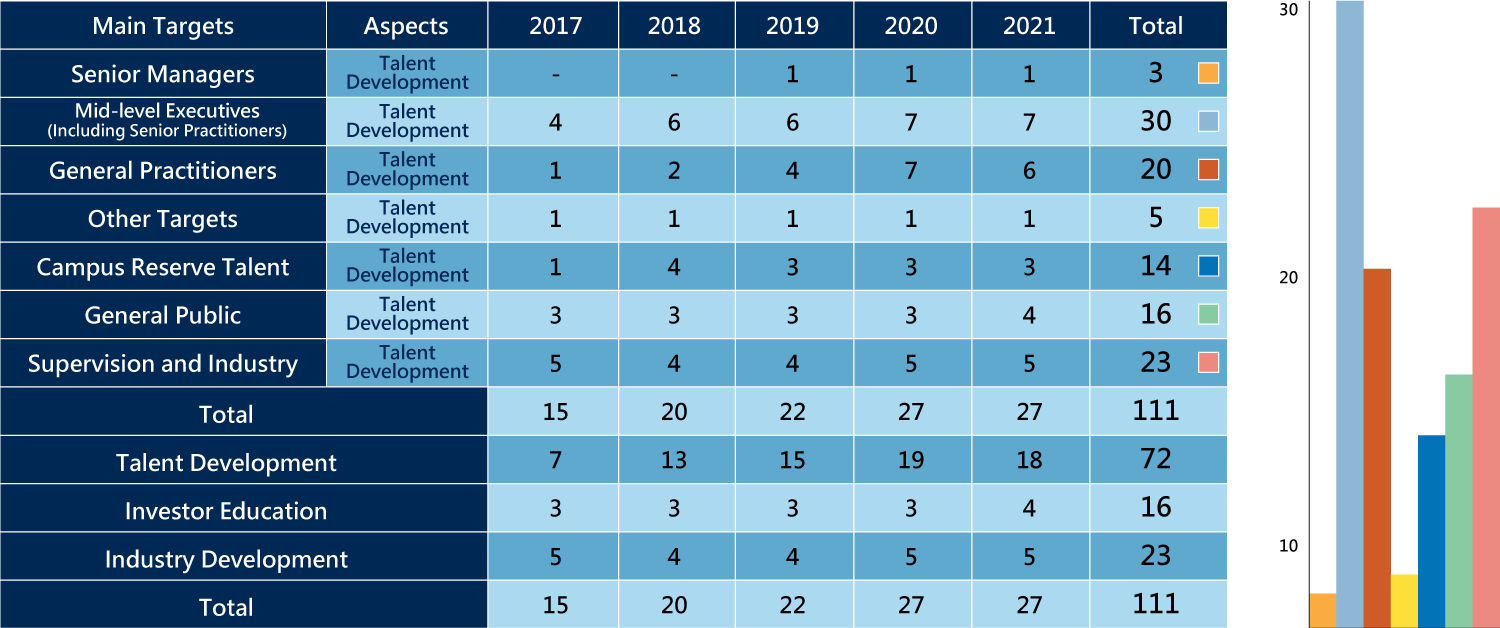

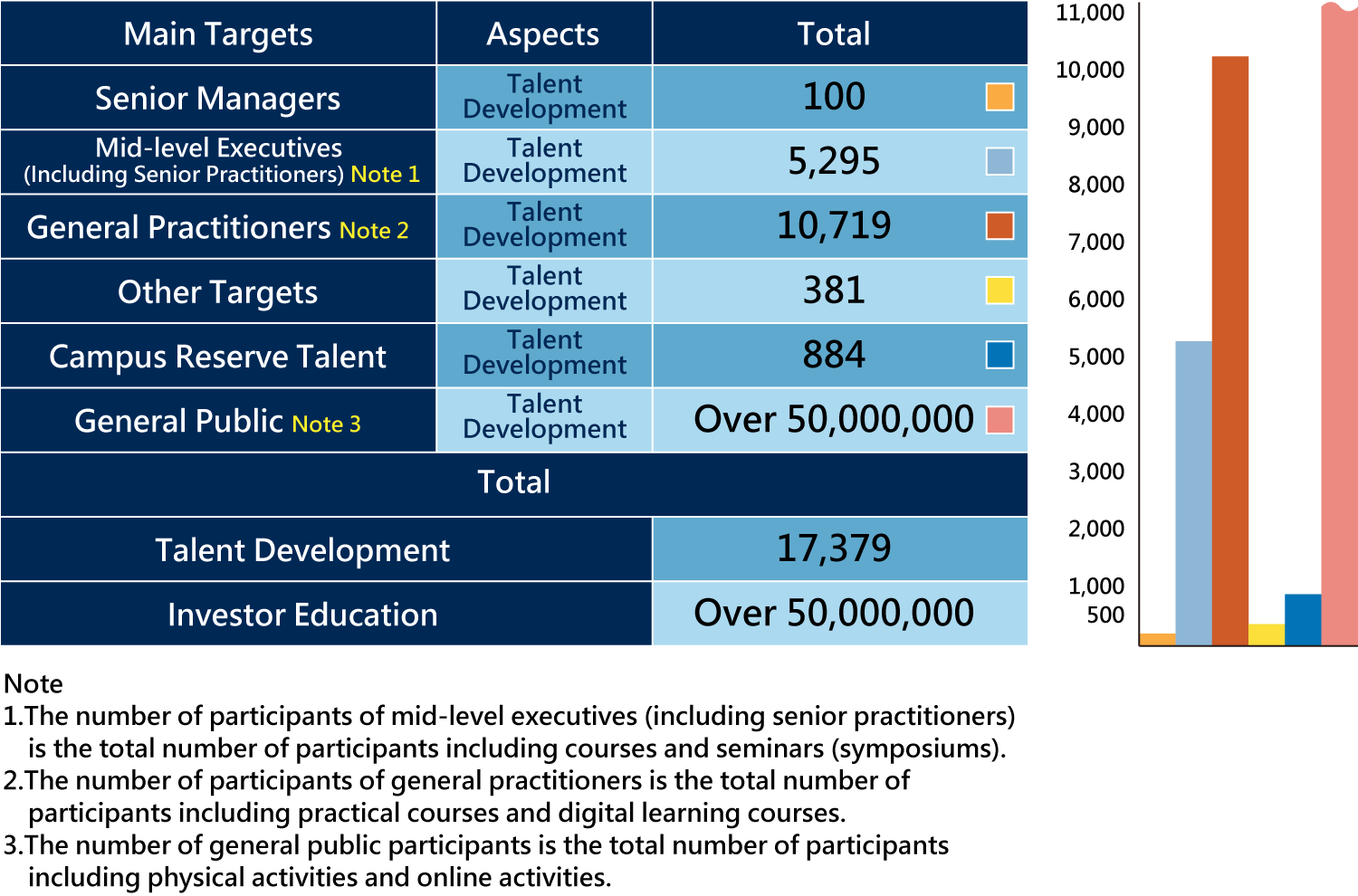

Overall Implementation Achievements from 2017 to 2021

1.Participating Projects

2.Number of Participants

FUTURE PROSPECTS